By Cameron Swindler, Associate Financial Advisor

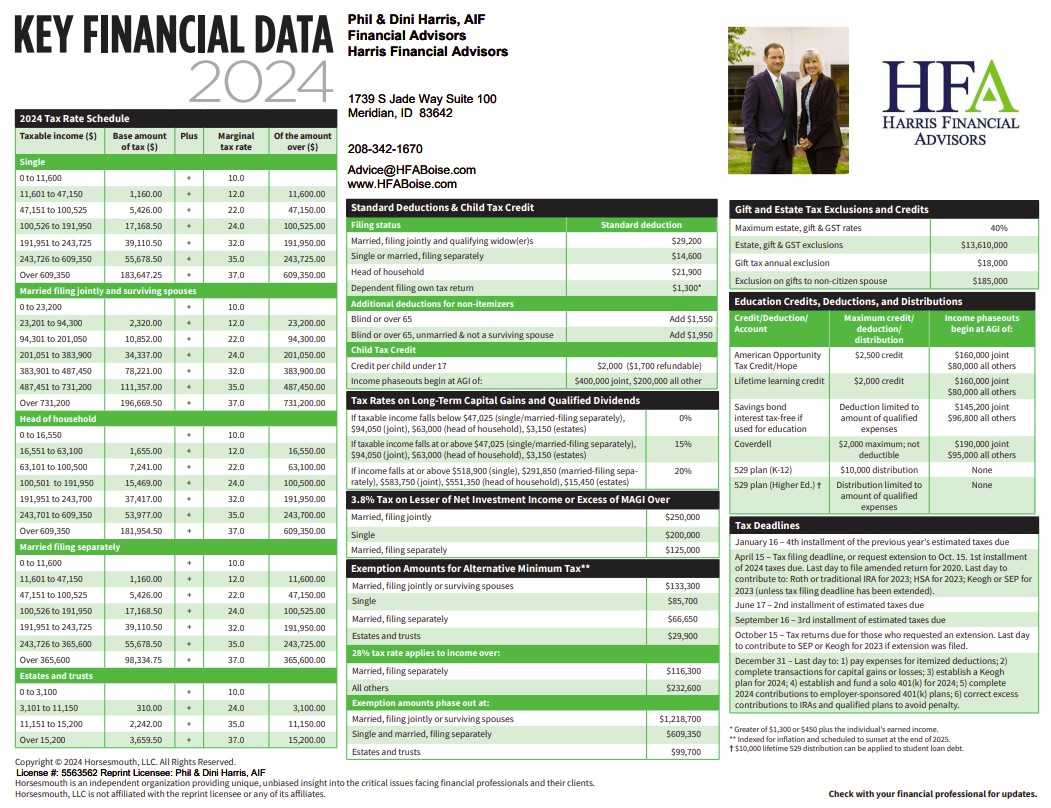

As we celebrate the New Year and prepare to file our taxes this 2023 season, it is important to keep in mind the incoming 2024 tax year. The IRS has made several updates to the tax thresholds, limits, and deductions for 2024, and part of an effective financial strategy involves planning your savings and investments around these changes. Here are some highlights to consider for this year.

Taxable Income Thresholds

To account for the recent rise in inflation, the IRS has raised the thresholds for taxable income across the board. For the 2024 tax year, the threshold for the lowest, 10.0% marginal rate, tax bracket, has increased to $11,600 for single filers and those married, filing separately. Those married, filing jointly, and surviving spouses have an increased threshold of $23,000. Those filing as head of household have a threshold of $16,550.

Deductions

Standard deductions have increased as well, with taxpayers filing as single or filing married, separately, allowed a $14,600 deduction. Those married, filing jointly, and qualifying widow(er)s can take a deduction of $29,200. Taxpayers filing as head of household can take a $21,900 deduction.

The standard deduction for dependents has changed to the greater of either $1,300 or $450 plus earned income.

For those of you over the age of 65 and who opt for the standard deduction, you can apply an increased, additional deduction of $1,550.

Retirement Contribution Limits and Deductions

Whether it’s Roth 401(K) or traditional 401(K), 403(B) or 457(B), employees who participate in workplace retirement plans can now contribute an additional $500, with the contribution limit increased to $23,000.

Depending on income and filing status, both the deductible contribution limit for traditional IRAs and the contribution limit for Roth IRAs have increased to $7,000. However, if you are over the age of 50, those contribution limits increase to $8,000.

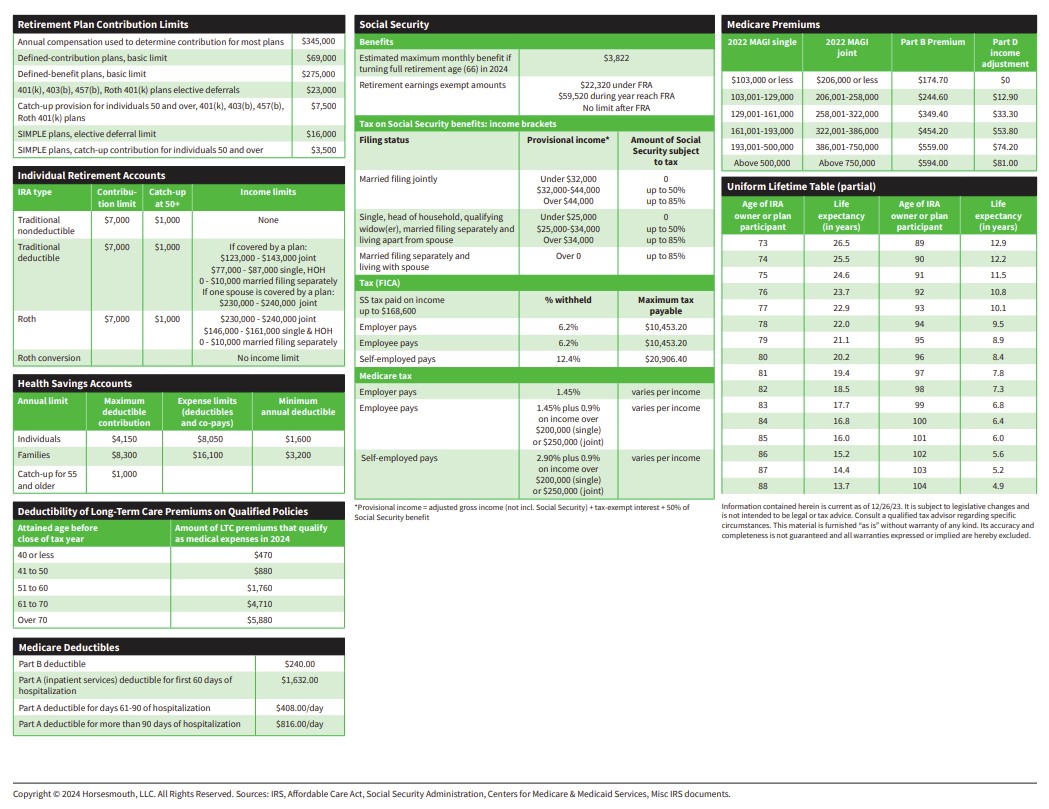

If you are interested in a full, easy-to-read, graphic of this year’s tax changes and more, please enjoy our Key Financial Data sheet. If you would prefer to receive a physical copy, let us know by signing up for our mailing list.

As always, please check with your CPA or tax advisor on how these changes may affect your specific tax situation. For help reviewing or designing an affective, financial strategy for 2024 please schedule a meeting with us.